texas property tax lenders

Well help you make an informed decision about property tax loans and show what Tax Ease can do. The buyer should create a new account and initiate the process under.

Home Ovation Lending Ovation Lending

The goal of the TPTLA.

. Use our convenient calculator to estimate your property tax loan payments. A Texas-based alliance of companies landowners and partners that advance and protect the profession of property tax lending to help Texas property owners. For a free no-obligation quote call 866 PROP-TAX.

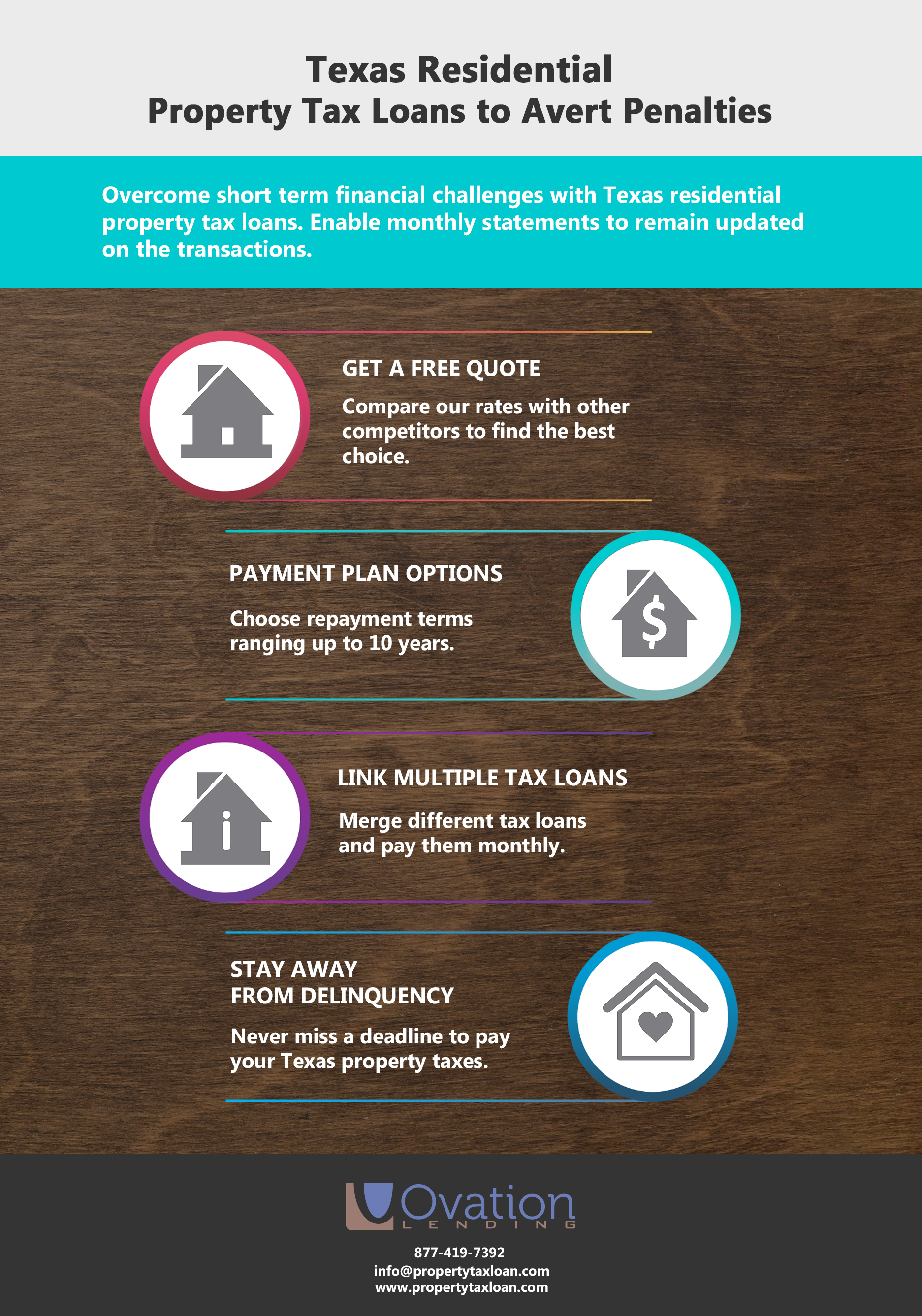

When reviewing different property tax lenders Texas residents have a lot to consider. You can expect to see the total amount owed and. Contact our professionals today.

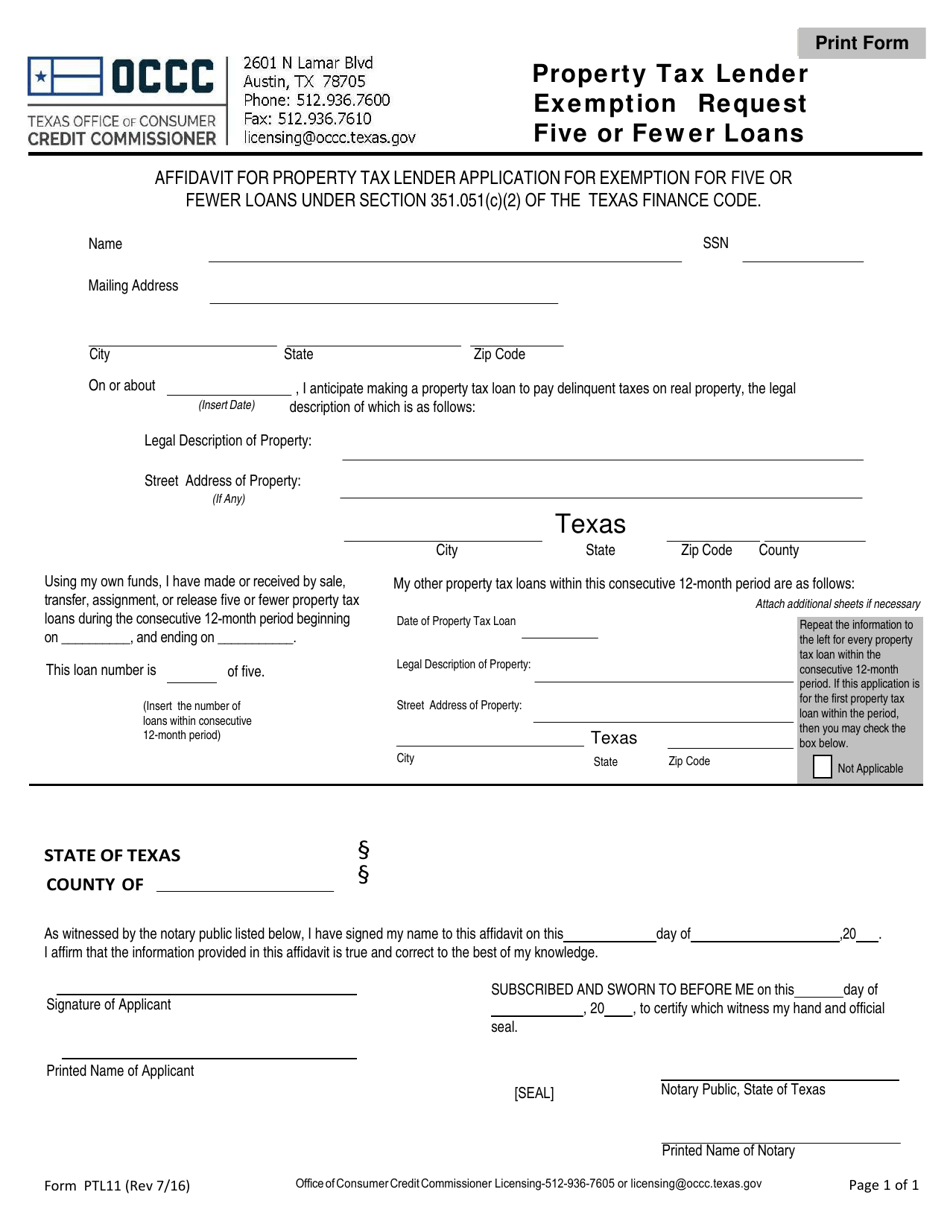

Contact the OCCC to ask them about the company you are considering. Apply for a loan with Texas Property Tax Loans here. We service our own loans so that the process is quick.

Texas property tax loans by Hunter-Kelsey can stop increasing county fees. Learn more contact us. November 18 2022.

TaxEase is one of the top lenders for property tax loans in Texas. Texas Tax Loans is a property tax lender specailizing in property tax loans. This office requires minimum standards of capitalization professionalism and official licensing for property tax lenders.

877 878 1956. Texas Property Tax Loans 2221 E. We service our own.

If you run a credible property tax lending company that offers flexible and low fixed rate property tax. PO Box 600998 Dallas Texas 75360 Telephone. Businesses wishing to complete a transfer of license can do so using ALECS.

A Hunter-Kelsey property tax loan can save your home and stop the rising fees and penalties on your delinquent tax bill. By now most property owners in Texas should have received their property tax bill in the mail. To avoid further county charges apply now with our quick form or call.

Get more info on property tax loans from the lenders at Tax. We always look for reputable property tax lenders to add to our Texass vendor list. Lamar Blvd Ste 130 Arlington TX 76006.

A property tax lender makes loans to property owners to pay delinquent or due property taxes. A The contract between a property tax lender and a property owner may require the property owner to pay the following costs. Transfer Existing License Application.

Dont risk losing your residential or business property. 214 696 1300 Toll Free. The lender receives a superior tax lien allowing it to.

Just fill in this easy form and a helpful licensed loan officer will contact you promptly. Our Texas property tax lenders will work with you to pay off your debt stress-free with low rates and a simple payment plan. Are you in need of a property tax loan in Texas.

Apply for a loan with Texas Property Tax Loans here. We offer property owners help to avoid penalties collection fees or foreclosure.

How Do Texas Property Tax Loans Work Advance Community Fund

Home Tax Solutions 2019 Winner Finance Elite Awards New World Report

How Do Texas Property Tax Loans Work Advance Community Fund

![]()

Tptla Texas Property Tax Lienholders Association

Mi Casa Financial Llc Texas Property Tax Loans In San Pedro Ave San Antonio Texas Weloans

Texas Property Tax Lenders Learn About Texas Property Tax Loans Lending From Tax Ease

Texas Property Tax System Is Bad It S About To Get Better

Texas Property Tax Lenders Reliance Tax Loans

Texas Residential Property Tax Loans To Avert Penalties Visual Ly

Your Guide To Property Taxes Hippo

Property Tax Lenders Texas Office Of Consumer Credit Commissioner

Propertytaxloanpros Com Property Tax Loans In Texas

Texas Property Tax Loan Resources Home Tax Solutions

Red Mccombs Invests Again In San Antonio Based Propel Financial Services Llc Run By Ceo Jack Nelson San Antonio Business Journal

Tptla Texas Property Tax Lienholders Association

Texas Property Tax Loans Funding Loans For Property Taxes

Property Tax Lenders Hunter Kelsey

Texas Property Tax Loans Real Estate Documents Sweed Notary Notary Public And Apostille In Euless Tx